Unleash Your Business’s Full Potential using Our BUD Framework:

Boost your cash flow, Unlock profitability and Drive revenue growth with our data-intelligence solutions

Boost Cash Flow

Discover hidden cash in your working capital with our state-of-the-art data-intelligence solutions.

Partner with us to reveal cost efficiencies within your business.

Leverage our expertise to expand into the most rewarding markets and customer segments.

Unlock Profitability

Drive Revenue Growth

B

U

D

Boost Cash Flow

Utilising proven data modelling techniques to identify cash opportunities across accounts receivables, payables and inventory.

Procure-to-Pay

Foster a cash-focused culture by implementing industry best practices to mitigate short-term cash flow risks

Benchmark payment terms against industry standards

Consolidate invoicing at supplier level

Optimise payment run frequency

Forecast-to-Fulfil

Order-to-Cash

Drive cash from measurable debtor improvement and reduce revenue leakage.

Predict customer payment behaviour to identify bad debtors and improve collections

Optimise payment terms to reduce DSO

Generate weekly scorecard for greater accountability

Size opportunities via invoice/ transactional data

Develop business case for sustainable improvements, such as, receivables financing

Uncover hidden cash by optimising inventory levels and strengthening your business's financial health.

Identify and liquidate non-moving or slow-moving inventory (NSI/SSI) to improve cash flow

Implement a robust KPI tracking and visualisation system to monitor inventory health

Assess supply chain vulnerabilities by analysing key supplier dependencies and lead times

Create a disciplined inventory management information system by creating one source of truth

Reduce days inventory outstanding (DIO)

B

Unlock Profitability

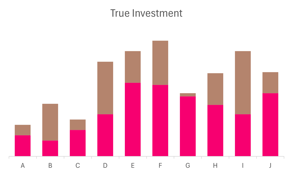

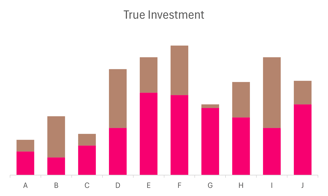

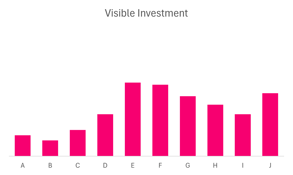

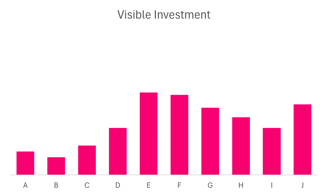

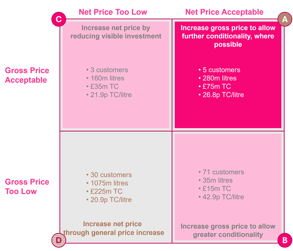

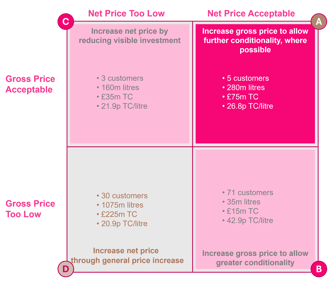

Creating a disciplined trade investment framework by validating management's hypothesis to optimise return on customer investments and avoid unnecessary trading risk.

Comprehensive Customer Analysis

Align trade investments with overall strategic objectives by clearly outlining desired outcomes to improve ROI.

Identify customer segments by grouping customers based on shared characteristics, needs and behaviours

Prioritise segments based on their potential lifetime value (LTV)

Allocate resources proportionally to customer LTV

Establish risk tolerance

Develop a rigorous evaluation process

Monitor KPIs through an intuitive dashboard

Forensic Due Diligence

Investigating and analysing in-depth companies' financial and operational aspects to uncover any irregularities, fraud, or other risks that may not be apparent through standard due diligence.

Define scope and objectives

Data collection and analysis (financial, operational, human resource, etc)

Design BI tool to identify patterns, anomalies, and red flags

Conduct interviews with key personnel

Prepare a comprehensive report documenting all findings

Data Asset Valuation

Understand value of your data to make better investment decisions and unlock its full potential.

Identify and categorise data assets

Determine the potential business value of each data asset

Data quality assessment

Estimate value using cost, market and/or income approaches

Establish a data governance framework

Create BI tool to track and monitor data quality and usage

U

Drive Revenue Growth

Positioning your business for success in the most rewarding market segments with our expert support.

Market Sizing and Analysis

Understanding of the market opportunity, potential for growth, and the project's impact for securing funding.

Define your business's target market

Determine market size

Conduct market research

Calculate Total Addressable Market (TAM), Serviceable Available Market (SAM) and Serviceable Obtainable Market (SOM)

D

Business Case Development

Comprehensive review of the business to identify opportunities to improve margin and release cash.

Collect a set of financial, organisational and operational data

Conduct management (commercial, finance and sales) team interviews and workshops to get perspectives and insight

Establish financial baseline

Develop and test hypothesis

Quantify potential opportunity

Prepare report to demonstrate the potential value of the business for growth and investment

Pricing Strategy

Align pricing strategy to identify revenue maximising price across the product and service portfolio.

Perform primary (Van-Westendorp, Gabor Granger, Conjoint Analysis) and secondary research

Identify price relationships of key brands by conducting elasticity analysis

Model profit impact of price scenarios and volume with the identified elasticity

Estimate competitor reaction to price movement and conduct gaming analysis

Identify revenue maximising price

Create BI tool to track and monitor price

How We Do It?

Typically, the initial exploration phase takes around 3 weeks, after which we can begin implementing the next steps. However, we're flexible with timelines and happy to work at your pace.

Proven data and analytics modelling technique to create bespoke business intelligence solutions.

Demo Dashboard

Ratika is a very professional person. I worked with her as client and during the period we worked together She was very engaged with the account manager. Her main skills are service oriented and focus on results.

Anheuser-Busch InBev

Client feedback